"How to Trade Like Hedge Fund Managers: The Stolen Wealth of Nations" by Eddie Freeman and Laura Holton unveils the secrets to building lasting wealth through proven trading strategies. Forget get-rich-quick schemes; this book provides a systematic approach, mirroring the methods of top hedge fund managers, but adapted for individual investors. Learn to predict market trends using fundamental and technical analysis, achieving success rates as high as 92%, according to the authors. The book emphasizes a simplified, disciplined approach, focusing on risk management and a winner's mindset. Discover how to "trade time" as well as price, incorporating macroeconomic factors and psychological insights for consistent, long-term growth, and finally achieve financial independence.

Review How to Trade Like Hedge Fund Managers

"How to Trade Like Hedge Fund Managers: The Stolen Wealth of Nations" by Eddie Freeman and Laura Holton presents a fascinating, albeit somewhat controversial, approach to investing. My overall feeling is a mixture of intrigue, appreciation, and cautious optimism. The book's strength lies in its ambitious attempt to demystify hedge fund strategies and make them accessible to the average investor. The authors clearly aim to equip readers with a systematic, long-term approach to wealth building, emphasizing discipline, risk management, and a keen understanding of macroeconomic trends.

I particularly appreciated the emphasis on the "KISS" principle – Keep It Simple, Stupid. In a world saturated with complex financial jargon and overly technical analyses, the book's efforts to simplify complex market dynamics and present actionable insights are commendable. The inclusion of real-life trading scenarios and the focus on developing a winner's mindset are also valuable additions, addressing not only the technical aspects of trading but also the crucial psychological elements. The integration of fundamental and technical analysis, along with the discussion of the importance of timing your trades, offers a holistic approach that resonates with me.

However, the book isn't without its drawbacks. Several reviewers have expressed concerns about the accessibility of the accompanying Excel spreadsheets, a crucial component for implementing the strategies outlined. This is a significant issue, as the book's effectiveness relies heavily on these tools. The failure of the download links in the Kindle version is a serious flaw that needs immediate attention from the authors. Furthermore, the claim of achieving success rates between 82% and 92% needs to be approached with a healthy dose of skepticism. While the book promotes a systematic approach, such high success rates are highly improbable in the unpredictable world of finance. No strategy, no matter how sophisticated, guarantees such consistent returns.

Another point of contention is the book's title and description. The phrase "Stolen Wealth of Nations" is sensationalistic and potentially misleading. While the book touches upon wealth transfer and the dynamics of market forces, it doesn't delve into conspiratorial or unethical practices. A more accurate and less provocative title might have been more appropriate.

Despite these reservations, the book offers valuable insights, especially for those seeking a long-term, disciplined approach to investing. The emphasis on macroeconomic understanding, risk management, and psychological preparedness is crucial for any successful investor. The book encourages a broader perspective than simply relying on standard chart indicators, which is a refreshing approach. However, readers should approach the stated success rates with caution and be aware of the potential issues with the downloadable resources. Overall, it's a thought-provoking read, though its effectiveness hinges heavily on the resolution of the issues raised concerning the accessibility of its supplementary materials. Ultimately, the value derived from this book will depend greatly on the reader's prior knowledge and their ability to critically evaluate the information presented.

Information

- Dimensions: 5.5 x 0.78 x 8.5 inches

- Language: English

- Print length: 342

- Publication date: 2024

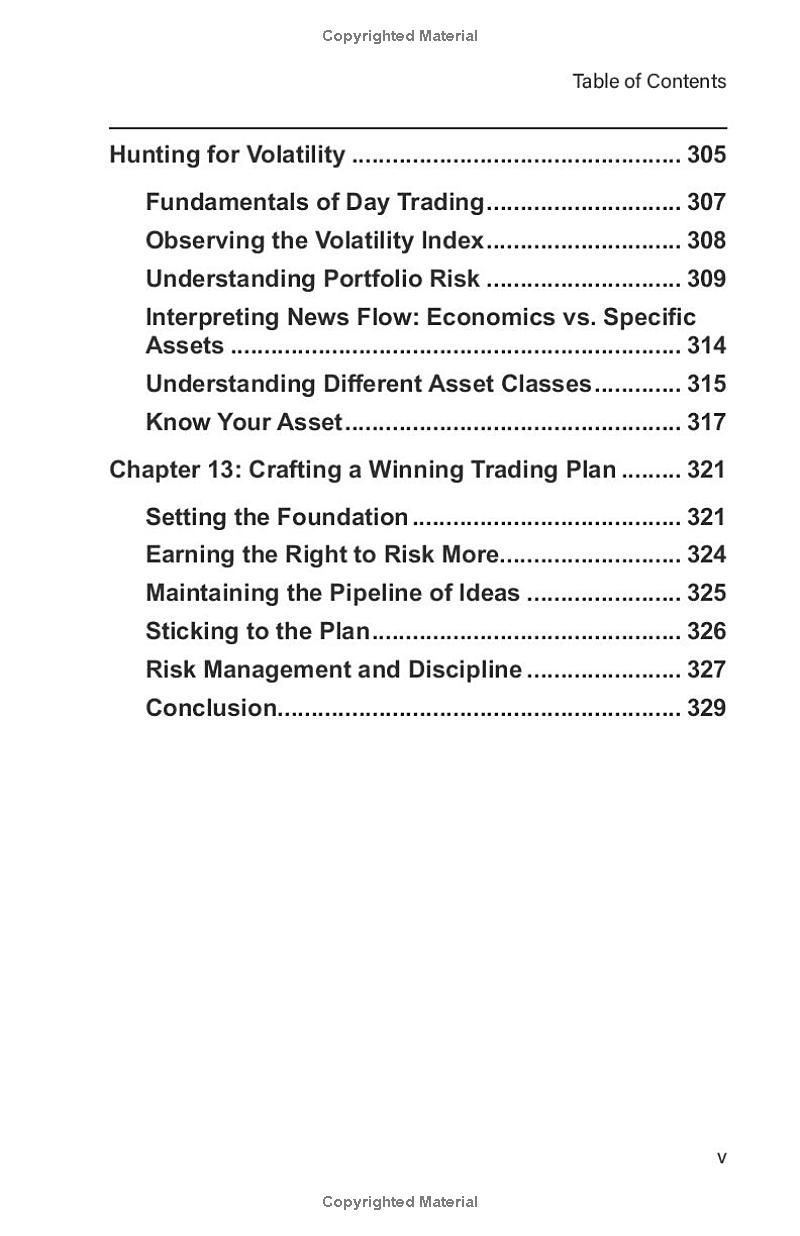

Book table of contents

- Introduction

- Part One: Getting Started

- Chapter 1: Blueprints on How to Use Leading Indicators in the United States

- Chapter 2: Reading the Pulse Confirmation Indicators in the U.S

- Chapter 3: Transitioning from U.S. to Eurozone

- Chapter 4: Unveiling the Dragon

- Part Two: Navigating the Market Depths

- Chapter 5: Embracing Volatility

- Chapter 6: Mastering the Art of Top-Down Analysis

- At the Industry Level: Manufacturing

- Where Do Trading Ideas Come From?

- The Concept of Beta and Alpha

- Chapter 7: Efficient Stock Selection

- Chapter 8: Capital Protection

- Chapter 9 Capital Protection:

Preview Book